Oxfam Australia has recently launched their Tax Justice Network Tax Extractives report. The report is designed to show the tax Australian-based companies pay when working in Africa.

The issues covered in the report are important – particularly to the development of the Democratic Republic of Congo. It is important we get the analysis right.

It is in interest of global tax transparency that Internationally accepted accounting standards are applied and respected. These are the underlying framework for initiatives such as the Extractive Industries Transparency Initiative (EITI) and international comparative discussions around tax contribution.

Unfortunately, these are not the standards applied in this report.

MMG values the reports produced by Oxfam, however we were disappointed to see that despite constructively engaging with Oxfam Australia and providing many opportunities for clarification, the report continues to contain material errors and omissions. Despite numerous opportunities, these were not corrected prior to publication.

As a result, the Report implies that MMG is not paying its fair share of tax and is not acting as a good corporate citizen.

MMG is a major investor, taxpayer, employer and purchaser of local goods and services. We are one of the largest investors in the DRC and proud of our significant economic and social contributions. We aim for the highest standards of corporate governance – including on tax. Our approach to date has been to transparently disclose tax and royalty payments as well as broader social contributions annually.

Given this, the issues alleged in the Oxfam report are too important to leave unchallenged.

Issue 1: Incorrect use of data that has been publicly disclosed in audited accounts

The report states that MMG does not pay it’s ‘fair share’ of taxes. This is not consistent with our audited accounts. The breakdown of taxes paid in each of the jurisdictions we operate in, can be found in our Sustainability Report which is available on our website.

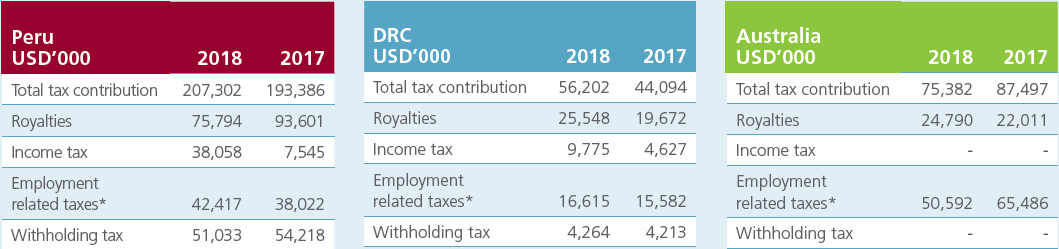

The table below is an extract from our 2018 Sustainability Report and shows the taxes paid by type and specifically in relation to income tax. Tax was paid in Peru and the Democratic Republic of Congo. In Australia, we still carry forward a tax loss position largely caused by the closure of our Century mine in 2017.

Our audited 2018 Annual Report shows our company’s effective tax rate as 55% and 53% for the 2018 and 2017 financial years respectively. This substantially exceeds the effective rate of taxation paid by the mining industry globally, as reported by the International Council on Mining and Metals (ICMM) which was 44% in 2016.

All payments disclosed by MMG have been produced in accordance with International Accounting Standards, audited in line with international accounting procedures and are consistent with the requirements of our listing rules under both the Hong Kong Stock Exchange, and our secondary listing under the Australian Stock Exchange.

The report contains several statements made by Oxfam Australia which relate to MMG’s tax and royalties’ disclosures and suggest that MMG may be seeking to mislead or engage in deceptive conduct.

We reject any assertion that we have misreported the amount of royalties paid. The company’s annual reports and accounts are audited by Deloitte and in earlier financial years by PricewaterhouseCoopers – both international reputable accounting and audit firms. MMG’s payment of royalties has been clearly disclosed in our Annual Report for each of the years analysed by Oxfam for their report.

Issue 2: Lack of acknowledgement that taxes paid directly in country lead to development outcomes

The report also claims that if additional resources were made available to the DRC Government this would result in additional expenditure on key drivers of sustainable development in the DRC including health and education, or food security and poverty alleviation.

This assumption significantly understates the challenge in any jurisdiction, and particularly in a developing country context, of ensuring appropriate levels of government investment in the provision of essential services like health and education; of ensuring equity of access for all people in the country irrespective of income status or physical location; and to deliver in the absence of critical infrastructure (like reliable electricity supplies, water and sanitation) essential to their effective functioning.

In country investment, local procurement, wages and direct expenditure on regional and social development represents perhaps the greatest and most direct contribution to development (as below).

Issue 3: Lack of recognition of MMG’s significant direct investment in the social and economic development of the DRC.

While Oxfam has not engaged MMG in a dialogue on any other payments made within the DRC, we note that in 2018 MMG directly invested US$931,163 in social development initiatives to increase the development outcomes to our host communities.

Our investments in the DRC are aligned to United Nations (UN) Sustainable Development Goals (SDGs) 1-6. MMG’s significant community support through a variety of social projects, funded by the site and aligned with the UN SDGs and the DRC Government’s recommendations in line with its poverty reduction program. Our area of influence includes 26 villages and approximately 25,000 inhabitants, in and around our mine site, according to the most recent socio-economic survey conducted in 2016.

MMG’s social development programs in the DRC are focused on four pillars:

- the essentials for life: water and agricultural projects,

- Health and well-being: the construction of health centres, malaria and AIDS, vaccination support and project promoting gender

- Securing incomes: promoting SMEs, contributing to employment

- Education: School infrastructure and teacher support, the school and university scholarship program, adult literacy.

More information regarding our ongoing social development programs can be found in MMG’s Sustainability Report.

Issue 4: Lack of recognition of MMGs leadership and commitment to resource transparency

In line with the ICMM member commitments on transparency of mining revenues, MMG recognises the value of disclosure of taxes, royalties and other payments made to governments. We believe the value of such disclosures in empowers citizens and civil society organisations to hold governments accountable for the effective expenditure or investment of those funds.

MMG supports the Extractive Industry Transparency Initiative in its efforts to improve transparency in countries rich in oil, gas and mineral resources through our membership fees and through our ongoing advocacy work in Australia, Peru and the DRC.

Issue 5: Some activities noted in the report pre-date MMGs involvement in the DRC

Oxfam also reported that there were instances of under-pricing copper sales at the Kinsevere mine. This example not only fails to take into consideration the pricing of copper concentrate but also pre-dates MMGs involvement in the country.

The examples of copper pricing in the DRC were added to the final version of the report and MMG did not have an opportunity to comment on this example prior to the report’s release.

To a view a copy of MMG’s response to Oxfam Australia click here.